Employee Withholding 2025 - The percentage method and wage bracket method withholding tables, the employer instructions on how to figure employee withholding, and the amount to add to a nonresident alien employee's wages for figuring income tax withholding are. Federal withholding tables determine how much money employers should withhold from employee wages for federal income tax (fit). This form tells employers how much money to withhold from the employee’s pay for federal income tax.

The percentage method and wage bracket method withholding tables, the employer instructions on how to figure employee withholding, and the amount to add to a nonresident alien employee's wages for figuring income tax withholding are.

The 2025 tables for federal income tax withholding are now available, irs said during a recent payroll industry call.

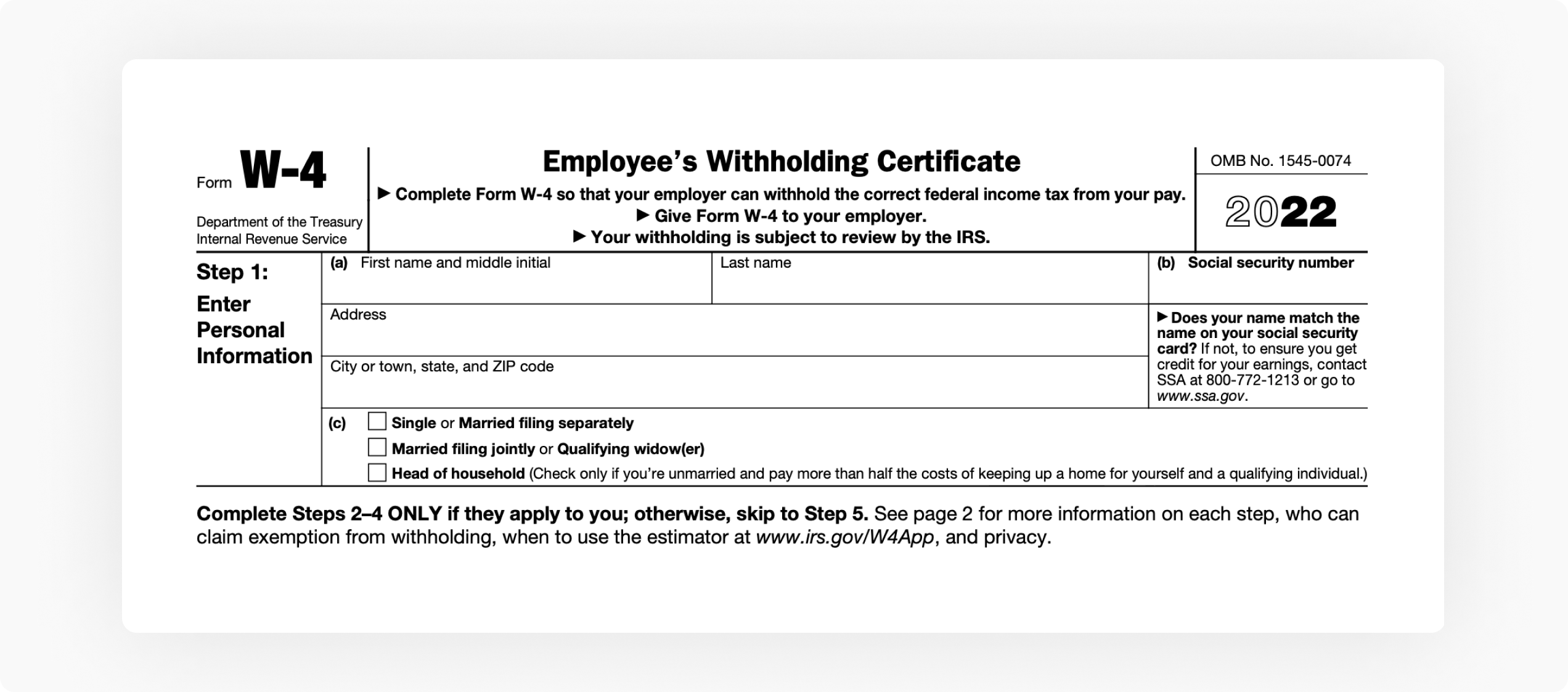

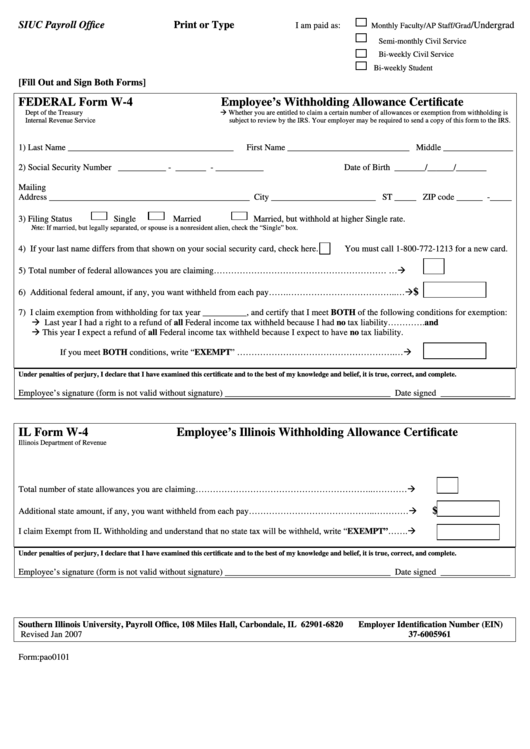

w4formemployeeswithholdingcertificate pdfFiller Blog, Social security and medicare withholding rates. The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total.

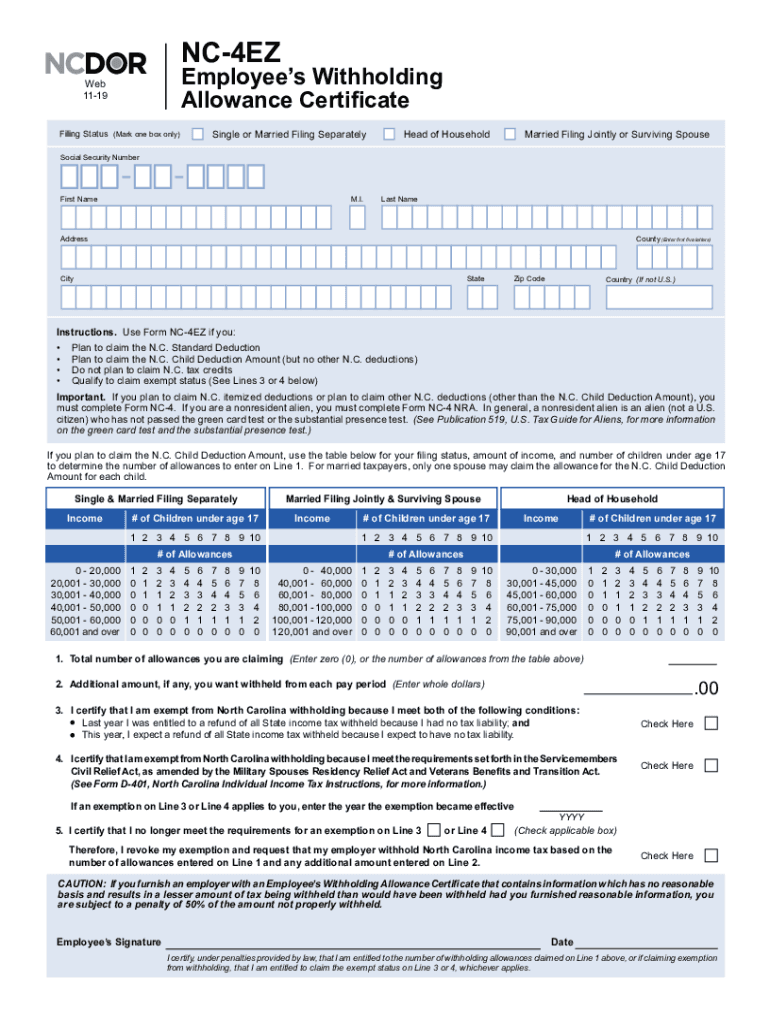

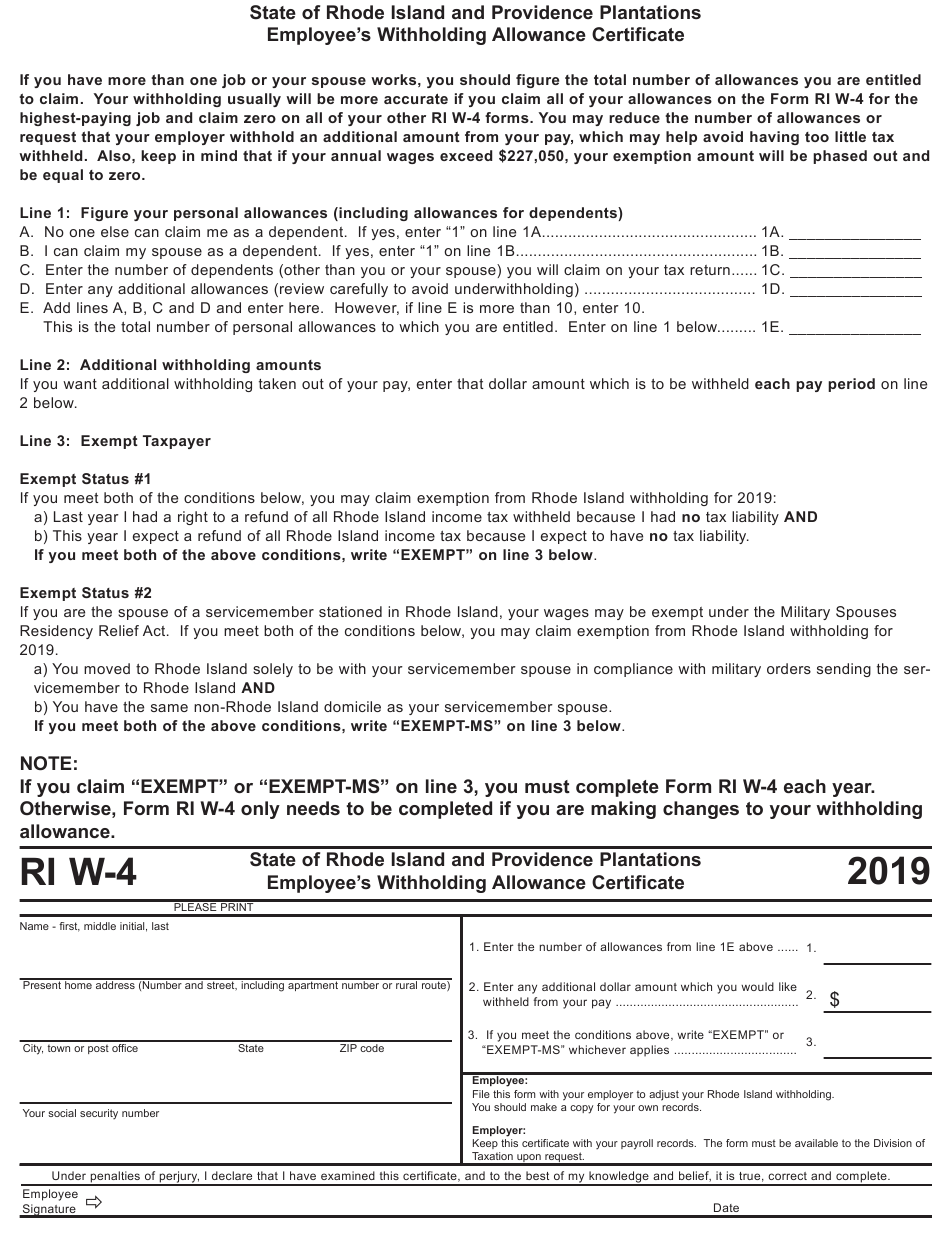

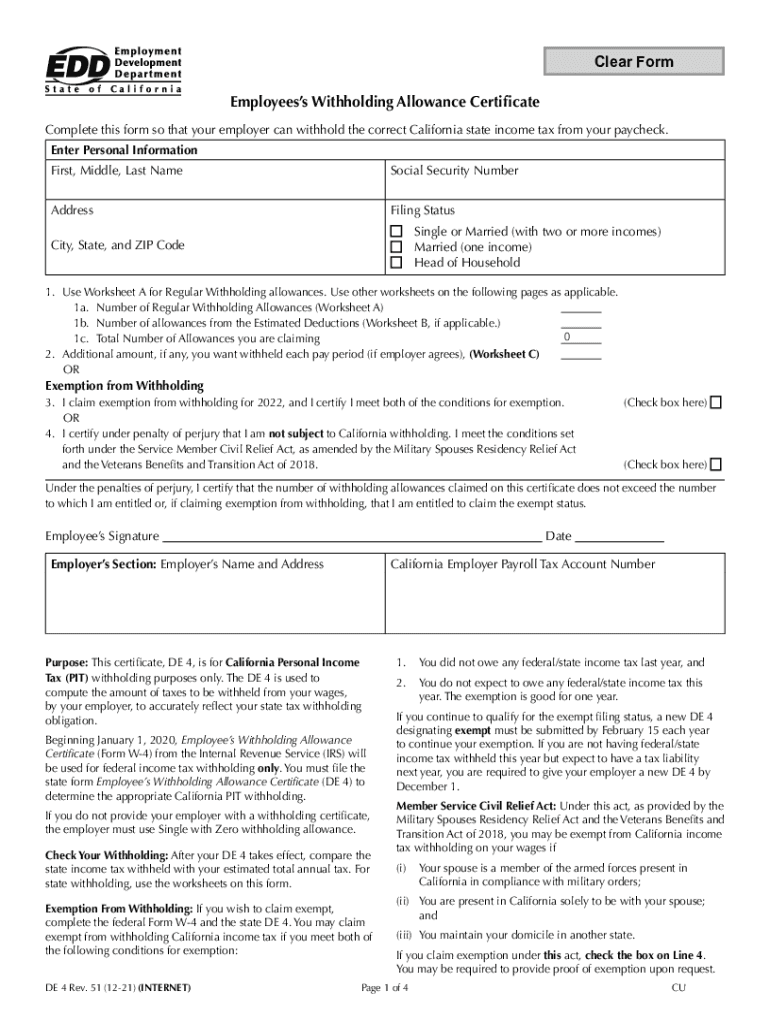

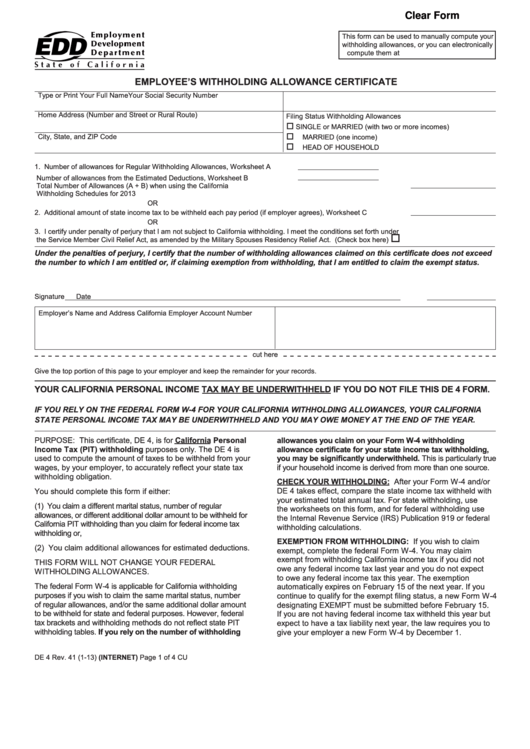

Fillable Employee'S Withholding Allowance Certificate Template, If you're an employer or another withholding payer, our tax withheld calculator can help you work out the tax you need to withhold from payments you make to employees and. It's important for employees to know the correct.

Form W4 (Employee's Withholding Certificate) template, The percentage method and wage bracket method withholding tables, the employer instructions on how to figure employee withholding, and the amount to add to a nonresident alien employee's wages for figuring income tax withholding are. Updated for 2025 (and the taxes you do in 2025), simply.

Free Printable W 4 Form For Employees Printable Templates, It's important for employees to know the correct. For 2025, the federal income thresholds, the personal amounts, and the canada employment amount have been changed based on changes in the consumer.

De4 20252025 Form Fill Out and Sign Printable PDF Template, An employee has no right of action against an employer with respect to any amounts deducted and withheld from the employee’s wages and paid over to the department in. Form used by individuals to direct their employer to withhold maryland income tax from their pay.

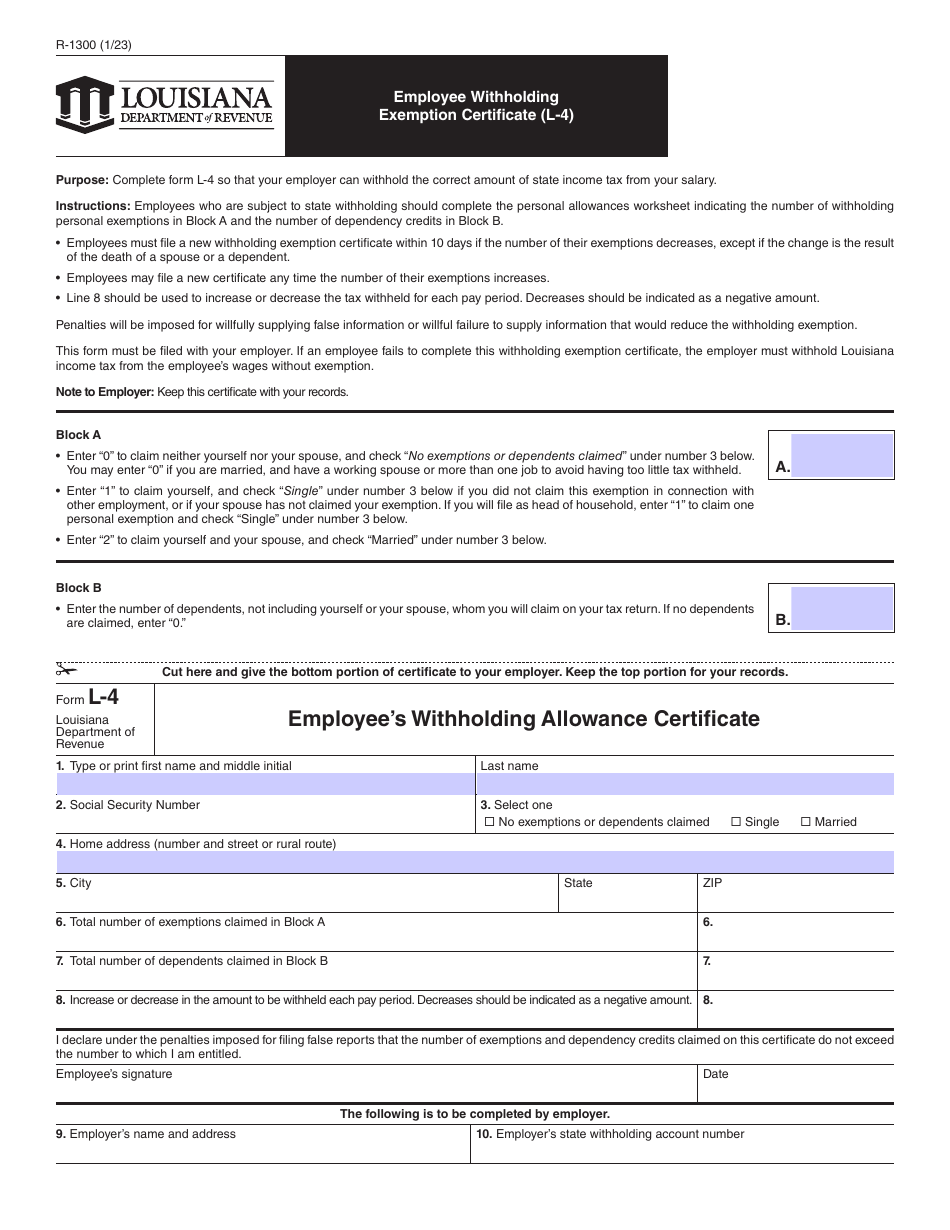

Form R1300 (L4) Download Fillable PDF or Fill Online Employee, Form used by individuals to direct their employer to withhold maryland income tax from their pay. Social security and medicare withholding rates.

Use this worksheet to figure the amount of your projected withholding for 2025, compare it to your projected tax for 2025, and, if necessary, figure any adjustment to the amount.

Employee Withholding 2025. Employee's maryland withholding exemption certificate. Use this worksheet to figure the amount of your projected withholding for 2025, compare it to your projected tax for 2025, and, if necessary, figure any adjustment to the amount.

W4 Form 2023 Printable Employee's Withholding Certificate W4 2025, The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The service posted the draft version of.